Momentum trading is a popular strategy used by traders to capitalize on trends in asset prices, aiming to ride the wave of upward or downward momentum for profit . While it can be a lucrative approach, it also comes with its set of challenges and limitations that traders must navigate effectively.

Scott McBrien, author of The Sigma Investor, was quoted by CNN in this article about momentum trading.

What is Momentum Trading

Momentum trading involves identifying assets that are exhibiting strong trends in their price movements and entering trades in the direction of the trend. Traders use various technical indicators, such as moving averages, MACD, or trendlines, to confirm the momentum and determine entry and exit points. Common momentum trading strategies include trend following, breakout trading, pullback trading, and momentum oscillator strategies. Using a systematic approach will help you avoid trading with your emotions.

Tools for Momentum Trading

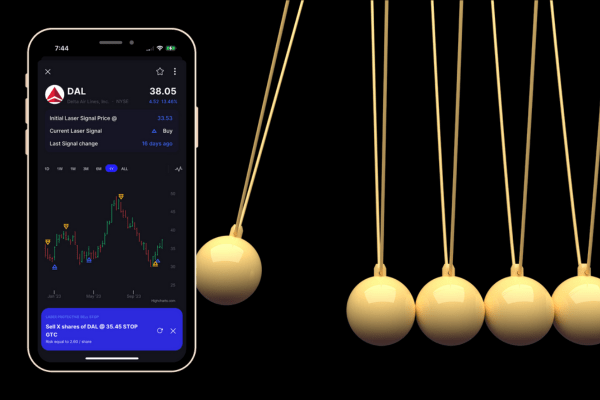

The Laser investing app provides exact buy and sell signals for momentum trading that can be accessed on your smartphone and clearly defines your risk before entering a trade. It also scans for potentially profitable momentum trading ideas from thousands of stocks down to a hundred or so each week.

Momentum Trading Pitfalls

Despite its potential for profits, momentum trading poses several challenges that traders need to be aware of:

- False breakouts and Whipsaws: Traders risk entering positions based on apparent momentum only to see the trend reverse quickly, resulting in losses.

- Market Volatility: High volatility can lead to erratic price movements, making it difficult to accurately identify genuine momentum trends.

- Overbought and Oversold Conditions: Relying solely on momentum oscillators can result in false signals, especially in strongly trending markets.

- Behavioral Biases: Traders may fall victim to behavioral biases such as overconfidence or confirmation bias, affecting their decision making.

- Transaction Costs: Frequent trading can result in significant transaction costs, eating into profits and reducing the effectiveness of the strategy.

- Drawdowns and Losses: Momentum trading is susceptible to drawdowns and periods of losses, requiring traders to remain disciplined and resilient.

8 Momentum Trading Strategies

To overcome these challenges and succeed in momentum trading, traders can follow these tips:

Invest in the direction of the “Raging River”

Or in other words, the direction of the market.

Set Stop-Loss Orders

Determine predetermined exit points for each trade to limit potential losses BEFORE entering the trade.

Practice Position Sizing

Avoid risking a significant portion of your capital on any single trade. Don’t risk more than 1% on any given trade idea. It’s a simple discipline that anyone can do if you know your exit strategy upfront. Buying and hoping is not a profitable strategy.

Stay Disciplined

Maintain emotional discipline and stick to your risk management plan, even during periods of volatility.

Adapt to Market Conditions

Be prepared to adjust your approach or even reverse your position based on changing market conditions and volatility levels.

Conduct Through Research

Backtest trading strategies, analyze past trades, and continuously refine your approach based on empirical evidence.

Choose Market Sectors

Some investors suggest diversifying your portfolio. However instead, choose stocks in the top 3 sectors where money is flowing into, or look to short stocks in the bottom 3 sectors where money is flowing out of those sectors. Watch a small basket of stocks very closely instead of throwing spaghetti against the wall and seeing which pieces stick.

Stay Informed

Keep abreast of market news, economic developments, and corporate announcements that may impact momentum trends. Keep abreast of the market news and conditions, but don’t trade from it. Instead, develop a disciplined set of trading rules that govern your entry and exit prices. The Laser really helps to reduce market noise that can negatively affect profits.”

Summary

Momentum trading offers traders the opportunity to profit from trends in asset prices, but it requires careful risk management, discipline and adaptability. By understanding the strategies, challenges and tips outlined above, traders can navigate the world of momentum trading more effectively and improve their chances of success in the markets.