Market Timing Strategy: Why It Beats Buy & Hold (And Why Most Investors Get It Wrong)

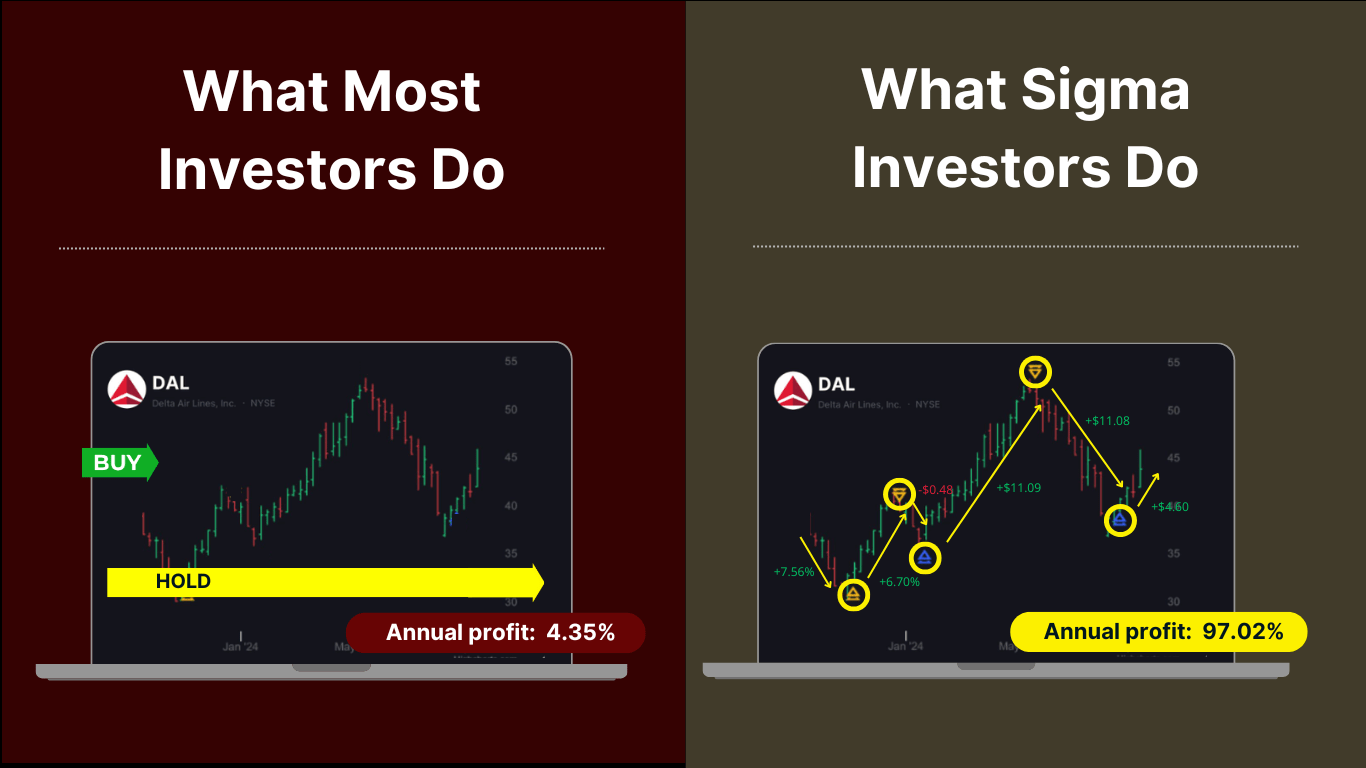

For years, investors have been told to buy and hold—set it and forget it. But here’s the problem: markets don’t move in a straight line. If you’re only holding stocks and waiting for the long haul, you’re missing out on massive profit opportunities. A smart market timing strategy helps traders navigate volatility, avoid major losses, and capitalize on market swings.

Market timing isn’t about guessing—it’s about strategy. And with the right tools, you don’t have to sit on losses, hoping for a recovery. This is why smart traders use The Laser™ to catch market trends in real time, maximizing returns in both directions.

Why a Market Timing Strategy is More Profitable Than Buy & Hold

Big financial institutions don’t want you to time the market. Instead, they push the same old strategy:

✔️ Buy and hold.

✔️ Keep adding money—even when the market dives, corrects or even crashes.

✔️ Don’t look at your account for 30 years.

If you do that, they make money no matter what. The more assets under management (AUM) they control, the more fees they collect. Whether your portfolio grows or crashes, they still profit.

But here’s the reality: markets fall faster than they rise.

When stocks tank, buy-and-hold investors have to make up for those losses, while Sigma Investors saw the opportunity to profit BEFORE the crash or at least, locked in the profits before the massive drop in prices. Keep in mind that a 20% pullback in stock prices takes a 25% gain to make up for those losses.

The Speed of Market Crashes (And How a Market Timing Strategy Helps)

How long does it take to build a Las Vegas hotel and casino? Years.

How long does it take to demolish it? Seconds.

The same thing happens in the stock market.

📉 The 2008 financial crisis wiped out over 50% of the S&P 500 in just 1.5 years—but the recovery took over 5 years.

📉 The 2020 COVID crash erased 34% of the S&P 500 in just 33 days—but the recovery took months.

📉 The 1987 Black Monday crash saw a 20.47% drop in a single day, with the market recovering to its pre-crash levels within 19 months.

Stocks crash 3–5x faster than they rise—and investors who only play the long side get crushed.

The Laser™ signals, help investors profit in any market. While others panic, Sigma Investors identify shorting opportunities and make money when stocks fall. If they prefer not to short stocks, they can at least lock in profits and wait until the next buy signal to get their favorite stock at lower prices for even greater gains.

Why Most Traders Fear Shorting (And Why That’s Dumb)

Most traders only know how to make money when stocks go up.

They’ve never been taught how to profit when stocks fall. That’s why shorting feels intimidating—not because it’s difficult, but because they don’t understand it.

Common Myths About Shorting

🔴 Unlimited losses? In theory, yes. But if you’re trading without stop losses, you’re already doing it wrong. Risk management makes shorting no different than going long.

🔴 Shorting is complicated. It used to be. Not anymore. If you can buy a stock, you can short one. Just set up a margin account with your broker, sign a few disclosures, and you’re good to go.

🔴 It’s betting against America. No, it’s what makes a market. Some investors buy and others sell. When you buy stocks, keep in mind that someone had to “sell” you that stock. It’s a zero sum game. The market moves both ways—smart traders profit in both directions.

🔴 Regulations make it hard. Nope. Shorting is easier than ever. The real barrier? Lack of knowledge.

FAQ: Answering Your Biggest Questions About Market Timing

Q: Can you really time the stock market?

A: Yes—but not the way most people think. Timing the market isn’t about guessing tops and bottoms—it’s about using data-driven signals to enter and exit trades at the right moments. The Laser™ helps traders do this with precision.

Q: Why is buy and hold risky in today’s market?

A: Markets are more volatile than ever. A 20% drop requires a 25% recovery just to break even. Instead of riding out every dip, smart investors adjust their strategy and profit when stocks fall.

Q: I don’t have time to watch the market all day or sit in front of my computer. I’m busy. Is that something I have to do?

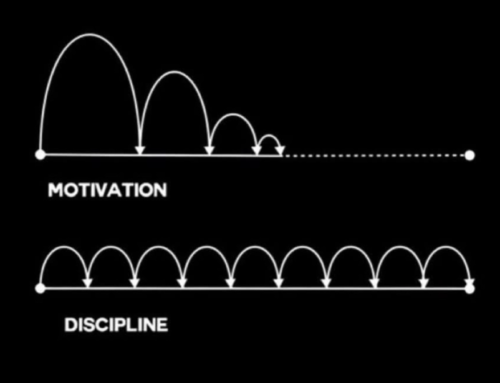

A: Absolutely not! The Laser’s Signals are weekly signals specifically designed for busy people just like you. You place your stop orders in the market ahead of time and then the market takes you out or into the trades that you want if your price is hit during the week. Once you learn how to do it, its really simple.

Q: What’s the fastest way to start profiting from market moves?

A: Start using a market timing strategy. The Laser™ provides real-time buy and sell signals so you can trade with confidence instead of guessing.

Your Next Move: Trade Smarter, Not Harder

Most investors will keep riding the buy-and-hold rollercoaster. They’ll watch their portfolios drop, hoping the market comes back.

Sigma Investors don’t wait—they act.