We’ve been told that shorting stocks is too risky. Too complicated. Too scary.

That’s nonsense.

The truth is, large financial institutions aren’t incentivized to teach you the benefits of shorting stocks. The more you stay away, the greater the fear you have, and the less you get involved. And that works out perfectly—for them.

They want you to blindly follow their playbook:

✔️ Put your money under their management.

✔️ Keep adding more—even when the market crashes.

✔️ Don’t look at your account for the next 30 years.

If you do that, you make them rich.

The more assets they manage, the more they profit—not you. They collect fees, regardless of your portfolio’s performance. And shorting? That requires active decision-making and knowledge, which means more customer service, more questions, and less reliance on their passive investment model.

That’s why they don’t teach you.

Shorting Stocks: The Strategy Wall Street Won’t Teach You

Shorting isn’t just for Wall Street pros; it’s a core strategy for smart traders who play both sides of the market and profit when stocks fall.

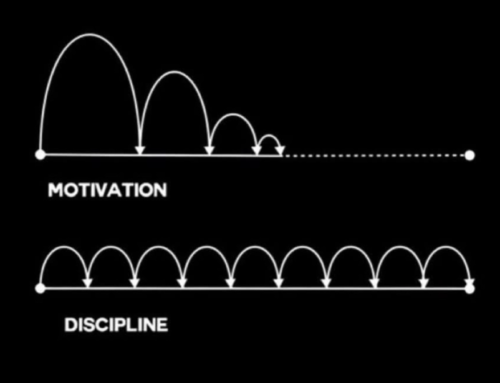

Why? Because markets fall much faster than they rise.

Think about this…

Think for a moment how long it takes to build a Las Vegas Hotel and Casino? Years, right?

Yet after 30 years of non-stop use, the time comes to build a more modern hotel and casino. So, the demo team comes in and gets set up. And with one push of a button, the building comes crashing down in seconds. Which took longer to accomplish? The build or the fall? Exactly.

And when that happens in the stock market, investors who only trade the long side get crushed.

1. Market Corrections and Crashes – Historically, stock market crashes and corrections happen much faster than bull runs. For example:

- The 2008 financial crisis wiped out over 50% of the S&P 500 in about 1.5 years, while it took over 5 years to recover.

- The COVID-19 crash in 2020 saw the S&P 500 drop by 34% in just 33 days, but the recovery took several months.

- The 1987 Black Monday crash saw a 22% drop in one day, which took years to fully recover from.

2. Average Rate of Change:

- Historically, bull markets generate average annual gains of 8-12% in major indices.

- Bear market declines often reach 20-50% in months or even weeks.

- Individual stocks can lose 10-20% in a day on bad earnings or news, whereas gaining 10-20% often takes multiple months.

- Remember a 20% “pullback” takes 25% upward stock movement to get back to even! Not 20%, but 25%!! That’s right, an extra 5%!!!

3. Psychological and Structural Factors:

- Fear is stronger than greed – Panic selling is more intense than FOMO buying.

- Leverage unwinding – Margin calls force rapid selling.

- Liquidity shocks – Sudden selling dries up liquidity, causing cascading drops.

- Short selling acceleration – Bearish traders pile on when a stock is falling.

Why Most Traders Fear Shorting (And Why That’s Dumb)

Most traders only know how to make money when stocks go up. They’ve never been taught how to profit when stocks fall. That’s why shorting feels intimidating—not because it’s actually difficult, but because most traders don’t understand it.

Let’s break down the common myths:

🔴 Unlimited losses?

In theory, yes. But if you’re trading without stop losses, you’re already doing it wrong. Risk management makes shorting no different than going long. When shorting, you must use a BUY STOP instead of a SELL STOP—that’s how you protect yourself.

🔴 Shorting is complicated.

It used to be. Not anymore. If you can buy a stock, you can short one. Just set up a margin account with your broker, sign a few disclosures, and you’re ready to go.

🔴 It’s betting against America.

No, it’s trading reality. The market moves both ways, and smart traders profit in both directions. Think about it—when you buy stocks, someone has to sell them to you, right? Shorting just flips the roles: you’re the one selling borrowed shares to those still willing to buy.

🔴 Regulations make it hard.

Nope. Shorting has never been easier. The real barrier? Lack of knowledge.

Why Shorting Stocks Gives You an Edge

Most traders only think about one thing—buying. Sigma Investors think about both. When markets turn, we don’t panic—we profit.

📉 Stocks fall 3-5 times faster than they rise.

📉 A 20% drop requires a 25% recovery just to break even.

📉 Fear is stronger than greed—panic selling happens faster than FOMO buying.

If you’re still playing the market like it’s 1985, you’re falling behind. The best investors today know how to profit when stocks go up and when they go down.

Are you ready to trade like a pro?

👉 Want real-time shorting signals? Start Your Free Trial of The Laser™