As we move through 2025, the stock market remains a battleground for optimism and caution. Investors are grappling with a complex mix of economic indicators, geopolitical developments, and technological advancements that could shape the trajectory of equities for the remainder of the year. In this article, we’ll debate both the bull and bear cases for stocks throughout the rest of 2025, providing a balanced perspective to help you navigate the uncertainties ahead.

The Bull Case for Stocks Throughout the Remainder of 2025

-

Artificial Intelligence and Productivity Boom

The widespread adoption of artificial intelligence (AI) across industries continues to drive a significant productivity boom. Companies leveraging AI for automation, data analysis, and customer engagement are seeing improved margins and revenue growth. This technological revolution is fueling earnings growth for tech giants and smaller innovators alike, creating a tailwind for equity markets. Scott McBrien, Chief Investment Officer for PNTHR Funds, suggests that “AI-driven productivity gains are likely to remain a key driver of equity returns throughout the rest of 2025, particularly for companies that successfully integrate these technologies into their operations.”

-

Interest Rate Cuts and Accommodative Monetary Policy

With inflation continuing to moderate, central banks, including the Federal Reserve, have pivoted to a more accommodative monetary policy. Lower interest rates will reduce borrowing costs for businesses and consumers, stimulating economic activity, and making equities more attractive relative to fixed-income investments. This could lead to a rally in both growth and value stocks. McBrien notes, “A dovish Fed throughout the remainder of 2025 could sustain a broad-based market rally, especially in rate-sensitive sectors like real estate and utilities.”

-

Resilient Consumer Spending

The global consumer has proven remarkably resilient in the face of economic challenges. Wage growth, coupled with declining inflation, is boosting disposable incomes and driving strong consumer spending. Sectors like retail, travel, and entertainment are benefiting significantly, lifting overall market sentiment. “Consumer discretionary stocks could continue to outperform if spending remains robust,” McBrien adds.

-

Geopolitical Stability and Trade Growth

While geopolitical risks are ever-present, there is optimism that some of the current tensions could ease throughout the remainder of 2025, leading to improved global trade dynamics. A more stable geopolitical environment would reduce uncertainty, encourage corporate investment, and support stock market performance. McBrien cautions, however, that “investors should remain vigilant, as geopolitical risks can shift rapidly.”

-

Corporate Earnings Growth

Corporate earnings are rebounding strongly as companies adapt to higher input costs and optimize operations. So far in 2025, sectors like energy, healthcare and communication services are leading the charge, providing a solid foundation for equity market gains. “Earnings growth will be the linchpin of any sustained bull market throughout the rest of 2025,” McBrien emphasizes.

The Bear Case for Stocks Throughout the Remainder of 2025

-

Economic Slowdown or Recession

Despite the optimism surrounding AI and productivity gains, there is a risk that the global economy could slow down throughout the remainder of 2025. High interest rates in 2023 and 2024 may have a lagged impact, leading to reduced business investment and consumer spending. A recession would likely weigh heavily on corporate earnings and stock prices. McBrien warns, “The delayed effects of tighter monetary policy could catch many investors off guard.”

-

Valuation Concerns

If the stock market rallies significantly in the first half of 2025, valuations could become even more stretched than they already are. Elevated price-to-earnings (P/E) ratios might make equities vulnerable to a correction, especially if earnings growth fails to meet lofty expectations. Investors could shift to safer assets, triggering a sell-off. “Valuations are a key risk heading into the latter half of 2025,” McBrien says. “Investors should be selective and focus on companies with strong fundamentals.”

-

Persistent Inflation and Higher-for-Longer Rates

While many expect inflation to moderate, there is a risk that it could remain stubbornly high due to structural factors like deglobalization, increased government spending, and labor shortages. In this scenario, central banks might keep interest rates higher for longer, increasing the cost of capital and pressuring equity valuations. McBrien suggests, “Inflation is the wildcard that could derail the bull case.”

-

Geopolitical Risks and Market Volatility

Geopolitical tensions, such as conflicts in key regions or trade wars, could escalate throughout the remainder of 2025, creating uncertainty and volatility in financial markets. A major geopolitical event could disrupt global supply chains, increase commodity prices, and erode investor confidence, leading to a market downturn. “Geopolitical risks are always a wildcard,” McBrien notes. “Investors should have a plan in place to manage volatility.”

-

Technological Disruption and Regulatory Challenges

While AI presents opportunities, it also poses risks. Rapid technological change could disrupt traditional industries, leading to job losses and social unrest. Additionally, governments may impose stricter regulations on tech companies, particularly in areas like data privacy and antitrust, which could weigh on stock performance. McBrien advises, “Regulatory risks are a growing concern, especially for big tech.”

Conclusion: Navigating the Crosscurrents with Discipline and Strategy

Confused? You’re not alone. The outlook for stocks throughout the remainder of 2025 is far from clear-cut. On one hand, the bull case highlights the potential for a productivity boom, accommodative monetary policy, and resilient consumer spending to drive market gains. On the other hand, the bear case warns of economic slowdowns, valuation concerns, and geopolitical risks that could derail the rally. Both are plausible conclusions.

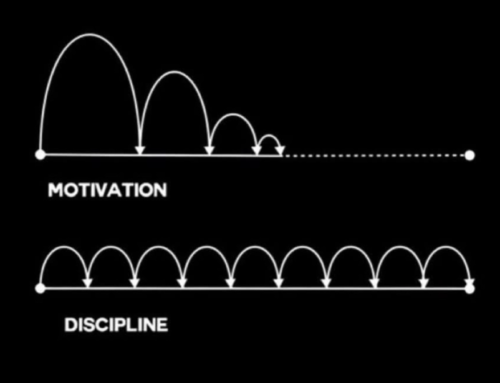

For investors, the key will be to remain agile, disciplined, and quantitative in their decision-making. Emotional decisions often lead to costly mistakes, which is why having a systematic, data-driven approach is critical. Tools like quantitative models, The Laser mobile app which provides accurate buy and sell signals for stocks, technical analysis, and risk management frameworks can help remove emotion from the equation and improve outcomes.

Additionally, investors should consider learning how to short stocks to take advantage of both sides of the market. While going long on stocks can be profitable in a bull market, short selling allows you to profit from declining prices during bear markets or corrections. As Scott McBrien, Chief Investment Officer for PNTHR Funds, often says, “The ability to go long and short is a powerful tool for generating alpha, especially in volatile markets.”

Whether you lean bullish or bearish, one thing is certain: the stock market will continue to be a dynamic and unpredictable arena, offering both opportunities and risks in equal measure. By staying informed, disciplined, and open to strategies like short selling, you can position yourself to thrive in any market environment.

For more information on how to navigate the complexities of the stock market, contact TheSigmaInvestor.com where you can learn how to navigate a strategy that works for you.